Invoice Factoring

What is Invoice Factoring:

Designed for small and medium-sized businesses to convert unpaid B2B invoices into immediate working capital.

Addresses cash flow bottlenecks caused by delayed customer payments.

Non-recourse factoring: Step By Step Capital assumes the risk of non-payment.

Key Features:

Businesses sell accounts receivable to Step By Step Capital at a discount rate (1%–5%).

Discount rate depends on invoice age, volume, and client credit quality.

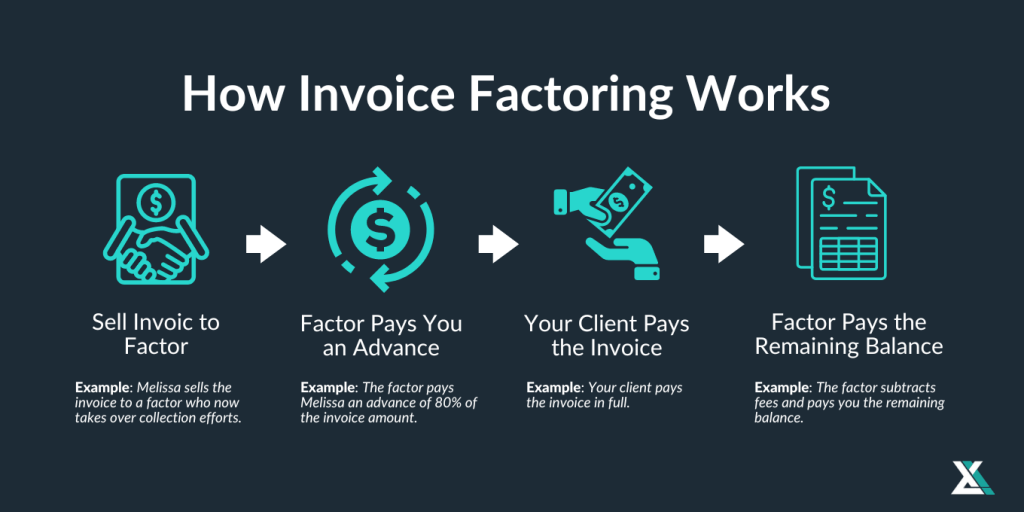

Advances 80–95% of invoice value upon approval; remainder (minus fees) paid after client settles invoice.

Funds transferred via ACH or wire transfer within 24–48 hours of approval.

Purpose:

Provides liquidity for rapid scaling, bulk inventory purchases, hiring surges, or meeting payroll/supplier commitments.

Ideal for industries like manufacturing, staffing, and wholesale distribution.

Eligibility:

Based primarily on the creditworthiness of the business’s customers, not the business’s own financial history.

Minimum invoice value: $5,000; payment terms up to 90 days.

Requires high-quality receivables from creditworthy clients; high-risk payers may not qualify.

Application Process:

Simple online inquiry with details on business operations, average invoice values, and payment terms.

Pre-qualification followed by swift due diligence, including invoice verification and Notice of Assignment.

Streamlined, paper-light process to minimize administrative burdens.

Benefits:

Immediate cash flow without stringent credit checks or collateral requirements of traditional bank loans.

Enhances liquidity for growth opportunities without accruing debt or diluting equity.

Transparent, performance-based fees with no hidden charges.

Flexible scalability: handles monthly invoice volumes from $50,000 to several million.

No long-term contracts, offering freedom to adjust participation.

Strategic Advantages:

Frees businesses from collection hassles, allowing focus on core operations.

Converts static receivables into dynamic capital for innovation and resilience.

Supports sustainable expansion in competitive markets.